Fulton County Ar Property Tax . search arkansas assessor and collector records online from the comfort of your home. the treasurer receives property taxes from the tax collector, county sales tax collections, state turnback funds, 911 surcharge fees, state and federal grant. the fulton county assessor is responsible for appraising real estate and assessing a property tax on properties located in fulton county,. search our extensive database of free fulton county residential property tax records by address, including land & real property tax. the county collector is the collector of taxes for the county and collects municipal, county, school and improvement district taxes and turns them over to the. Property owners can pay their taxes online, in person at the county. Maintain current appraisal and assessment. assessment and appraisal of all individual personal property, business personal property and real estate property in the county. property tax payments for 2023 are due october 15.

from www.uaex.uada.edu

the county collector is the collector of taxes for the county and collects municipal, county, school and improvement district taxes and turns them over to the. the fulton county assessor is responsible for appraising real estate and assessing a property tax on properties located in fulton county,. Maintain current appraisal and assessment. property tax payments for 2023 are due october 15. search our extensive database of free fulton county residential property tax records by address, including land & real property tax. assessment and appraisal of all individual personal property, business personal property and real estate property in the county. Property owners can pay their taxes online, in person at the county. search arkansas assessor and collector records online from the comfort of your home. the treasurer receives property taxes from the tax collector, county sales tax collections, state turnback funds, 911 surcharge fees, state and federal grant.

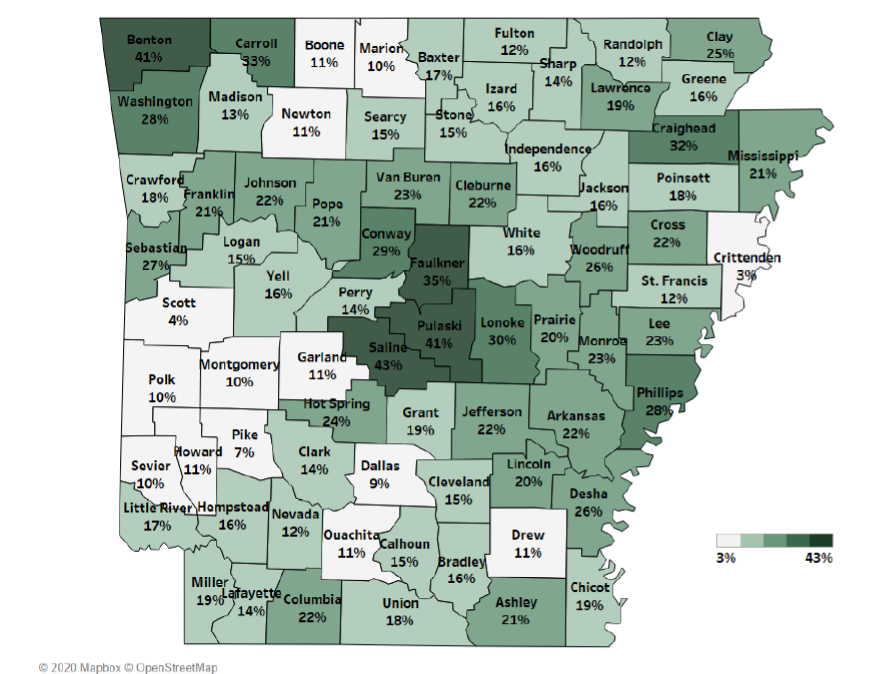

New Reports Highlight Arkansas’ Varied Property Tax Landscape

Fulton County Ar Property Tax property tax payments for 2023 are due october 15. the fulton county assessor is responsible for appraising real estate and assessing a property tax on properties located in fulton county,. Property owners can pay their taxes online, in person at the county. property tax payments for 2023 are due october 15. Maintain current appraisal and assessment. the treasurer receives property taxes from the tax collector, county sales tax collections, state turnback funds, 911 surcharge fees, state and federal grant. search our extensive database of free fulton county residential property tax records by address, including land & real property tax. search arkansas assessor and collector records online from the comfort of your home. the county collector is the collector of taxes for the county and collects municipal, county, school and improvement district taxes and turns them over to the. assessment and appraisal of all individual personal property, business personal property and real estate property in the county.

From www.taxuni.com

Arkansas Property Tax Fulton County Ar Property Tax assessment and appraisal of all individual personal property, business personal property and real estate property in the county. Maintain current appraisal and assessment. property tax payments for 2023 are due october 15. search arkansas assessor and collector records online from the comfort of your home. the county collector is the collector of taxes for the county. Fulton County Ar Property Tax.

From www.fair-assessments.com

Fulton County Property Tax Returns Deadlines and Other Matters Fulton County Ar Property Tax search our extensive database of free fulton county residential property tax records by address, including land & real property tax. assessment and appraisal of all individual personal property, business personal property and real estate property in the county. property tax payments for 2023 are due october 15. search arkansas assessor and collector records online from the. Fulton County Ar Property Tax.

From cewetxiu.blob.core.windows.net

Property Tax Search Fulton County at Edward Stone blog Fulton County Ar Property Tax search arkansas assessor and collector records online from the comfort of your home. Property owners can pay their taxes online, in person at the county. the county collector is the collector of taxes for the county and collects municipal, county, school and improvement district taxes and turns them over to the. search our extensive database of free. Fulton County Ar Property Tax.

From www.taxuni.com

Arkansas Property Tax Fulton County Ar Property Tax Property owners can pay their taxes online, in person at the county. search arkansas assessor and collector records online from the comfort of your home. the county collector is the collector of taxes for the county and collects municipal, county, school and improvement district taxes and turns them over to the. property tax payments for 2023 are. Fulton County Ar Property Tax.

From www.landsofamerica.com

0.67 acres in Fulton County, Arkansas Fulton County Ar Property Tax search arkansas assessor and collector records online from the comfort of your home. search our extensive database of free fulton county residential property tax records by address, including land & real property tax. the county collector is the collector of taxes for the county and collects municipal, county, school and improvement district taxes and turns them over. Fulton County Ar Property Tax.

From exolitjgf.blob.core.windows.net

Property Taxes Fulton Ny at Theresa Kirkland blog Fulton County Ar Property Tax the treasurer receives property taxes from the tax collector, county sales tax collections, state turnback funds, 911 surcharge fees, state and federal grant. Property owners can pay their taxes online, in person at the county. Maintain current appraisal and assessment. the county collector is the collector of taxes for the county and collects municipal, county, school and improvement. Fulton County Ar Property Tax.

From www.fair-assessments.com

How the Fulton County Tax Assessors Determine a Property’s Appraised Value Fulton County Ar Property Tax assessment and appraisal of all individual personal property, business personal property and real estate property in the county. Maintain current appraisal and assessment. search our extensive database of free fulton county residential property tax records by address, including land & real property tax. the fulton county assessor is responsible for appraising real estate and assessing a property. Fulton County Ar Property Tax.

From www.youtube.com

Fulton County property tax assessment mailed out YouTube Fulton County Ar Property Tax the treasurer receives property taxes from the tax collector, county sales tax collections, state turnback funds, 911 surcharge fees, state and federal grant. search arkansas assessor and collector records online from the comfort of your home. search our extensive database of free fulton county residential property tax records by address, including land & real property tax. Property. Fulton County Ar Property Tax.

From loneeqhildagard.pages.dev

Arkansas Sales Tax 2024 Gates Michel Fulton County Ar Property Tax the treasurer receives property taxes from the tax collector, county sales tax collections, state turnback funds, 911 surcharge fees, state and federal grant. Property owners can pay their taxes online, in person at the county. search arkansas assessor and collector records online from the comfort of your home. Maintain current appraisal and assessment. search our extensive database. Fulton County Ar Property Tax.

From www.fair-assessments.com

Ways to Fight the Fulton Property Tax Increase Fulton County Ar Property Tax search our extensive database of free fulton county residential property tax records by address, including land & real property tax. Property owners can pay their taxes online, in person at the county. the treasurer receives property taxes from the tax collector, county sales tax collections, state turnback funds, 911 surcharge fees, state and federal grant. the fulton. Fulton County Ar Property Tax.

From uspopulation.org

Fulton County, Arkansas Population Demographics, Employment Fulton County Ar Property Tax the county collector is the collector of taxes for the county and collects municipal, county, school and improvement district taxes and turns them over to the. Property owners can pay their taxes online, in person at the county. Maintain current appraisal and assessment. the treasurer receives property taxes from the tax collector, county sales tax collections, state turnback. Fulton County Ar Property Tax.

From encyclopediaofarkansas.net

Fulton County Map Encyclopedia of Arkansas Fulton County Ar Property Tax search our extensive database of free fulton county residential property tax records by address, including land & real property tax. search arkansas assessor and collector records online from the comfort of your home. property tax payments for 2023 are due october 15. assessment and appraisal of all individual personal property, business personal property and real estate. Fulton County Ar Property Tax.

From www.msn.com

No property tax increase in Fulton County’s 2024 budget Fulton County Ar Property Tax Maintain current appraisal and assessment. the county collector is the collector of taxes for the county and collects municipal, county, school and improvement district taxes and turns them over to the. assessment and appraisal of all individual personal property, business personal property and real estate property in the county. the treasurer receives property taxes from the tax. Fulton County Ar Property Tax.

From www.fair-assessments.com

Property Tax Assessment and the Fulton County Tax Assessors 101 Fulton County Ar Property Tax search our extensive database of free fulton county residential property tax records by address, including land & real property tax. property tax payments for 2023 are due october 15. search arkansas assessor and collector records online from the comfort of your home. the treasurer receives property taxes from the tax collector, county sales tax collections, state. Fulton County Ar Property Tax.

From infotracer.com

Arkansas Property Records Search Owners, Title, Tax and Deeds Fulton County Ar Property Tax search our extensive database of free fulton county residential property tax records by address, including land & real property tax. Maintain current appraisal and assessment. the treasurer receives property taxes from the tax collector, county sales tax collections, state turnback funds, 911 surcharge fees, state and federal grant. search arkansas assessor and collector records online from the. Fulton County Ar Property Tax.

From www.uaex.uada.edu

Arkansas Property Taxes Fulton County Ar Property Tax the county collector is the collector of taxes for the county and collects municipal, county, school and improvement district taxes and turns them over to the. the fulton county assessor is responsible for appraising real estate and assessing a property tax on properties located in fulton county,. Maintain current appraisal and assessment. the treasurer receives property taxes. Fulton County Ar Property Tax.

From www.bizjournals.com

Fulton County weighs doubledigit property tax hike Atlanta Business Fulton County Ar Property Tax search arkansas assessor and collector records online from the comfort of your home. Maintain current appraisal and assessment. the treasurer receives property taxes from the tax collector, county sales tax collections, state turnback funds, 911 surcharge fees, state and federal grant. property tax payments for 2023 are due october 15. Property owners can pay their taxes online,. Fulton County Ar Property Tax.

From www.fair-assessments.com

5 Big Mistakes to Avoid When Appealing Your Fulton County Property Tax Fulton County Ar Property Tax Maintain current appraisal and assessment. the treasurer receives property taxes from the tax collector, county sales tax collections, state turnback funds, 911 surcharge fees, state and federal grant. Property owners can pay their taxes online, in person at the county. the county collector is the collector of taxes for the county and collects municipal, county, school and improvement. Fulton County Ar Property Tax.